Become A Donor

The TPMF is a tax-exempt organization under Section 501(c)(3) of the US Internal Revenue Code thereby making US dollar donations fully tax-deductible and making the organization eligible to receive QCDs (see below).

Tax ID is 74-2952209

TPMF Outreach Programs Include:

- Medical missions

- Indigent care and diabetic shoe support

- Post-graduate residency mission grants and case awards

- Support and job networking of Texas podiatric residency training programs

- Scholarships and education support for the UTRGV Texas School of Podiatric Medicine

Become a Donor Today

To become a Sole Supporter or other donor level, download this form or email directly to TPMF Executive Director at krista.richter@yahoo.com. Donations made by credit card are requested to please add 4% to cover processing fees. Thank you to all of our Sole Supporter annual donors! All Donations are Much Appreciated!

Donations for UTRGV Scholarships May Be Made in 2 Ways:

1. Directly to the UTRGV Podiatry for Future scholarship fund through this link

2. Made to TPMF (noted for UTRGV) and included in annual disbursement used for scholarships

Memorial Endowment Fund

Remembering colleagues: Giving back and making a difference for the future of podiatric medicine.

Designate contributions in memory of a loved one. The TPMF Memorial Fund supports the endowment to give multiple grants per year.

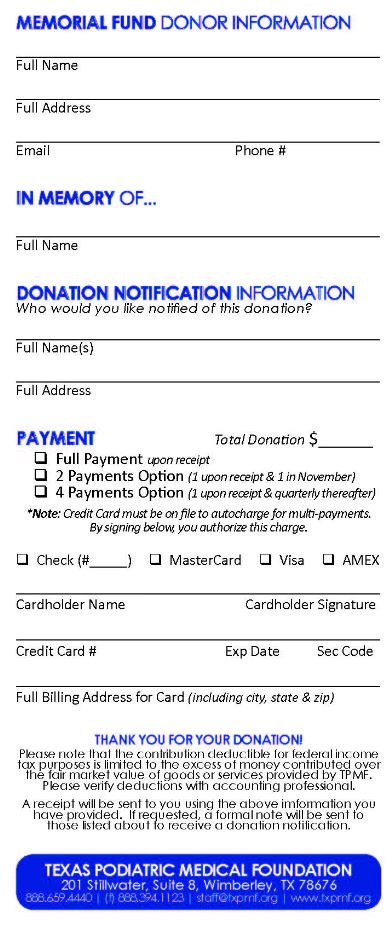

Download the memorial fund donor card here

TPMF may also be listed as a beneficiary for life insurance policies, or become a designee in your estate planning. Verify including donation information with your estate attorney, or private estate planner. For questions on estate documentation, contact Stan Churchwell, DPM, JD.

If you are 70-1/2 or older, you are eligible to make a Qualified Charitable Donation (QCD). This a direct transfer of funds from your IRA custodian, payable to a qualified charity such as TPMF. The main benefit of making a QCD is that the amount donated is excluded from taxable income, which is unlike regular withdrawals from an IRA. Keeping your taxable income lower may reduce the impact to certain tax credits and deductions, including Social Security and Medicare. For additional information about QCDs, please speak with your tax advisor.

Financial donations may be mailed, taken by phone or submitted via this application form below.

TPMF Memorial Donations

In Memory of Dr. Oran Burnett

-2019 Bandera Meeting Attendees

-Dr. Don & Nelda Falknor

Thank you to the many friends of TPMF that made memorial donations in honor of Doreen Bohrer to start this fund!